Tom Patrick from Barwon Investment Partners shares insights with Larence Parker-Brown from The Inside Network on today’s healthcare real estate opportunity.

Blog

-

Beware today’s 20-year corporate bonds: Yarra Capital

Investors chasing yields of at least 6 per cent from selected investment-grade bonds should pause and consider if they are getting a sufficient return for the level of risk they are taking. In many cases, it’s likely that an actively managed diversified credit strategy could generate similar yields at a lower level of risk.

Recent appetite for 20-year paper appears to be driven in part by private wealth managers and others aiming to lock-in 6 per cent-plus yields by cherry-picking direct bond investments, with price technicals and credit fundamentals taking a back seat. The phased abolition of bank hybrid securities in Australia is also adding to demand, as domestic income-hungry investors seek alternative holdings for their portfolios.

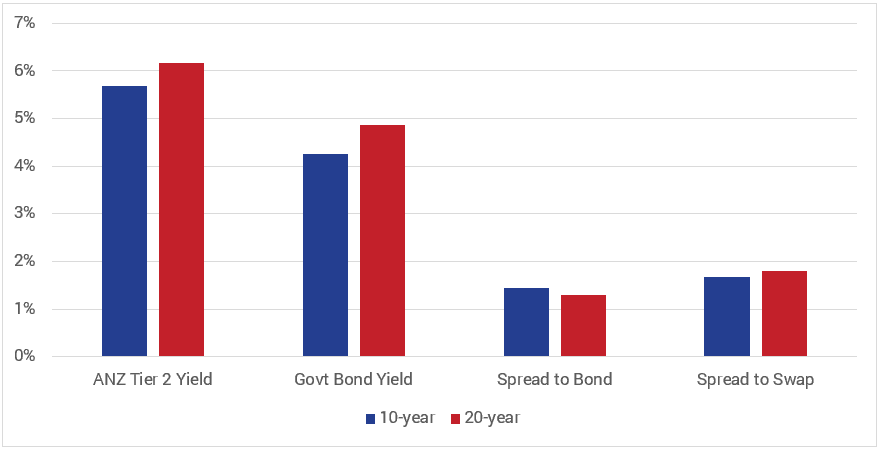

An over-eagerness to reach the “magical” 6 per cent yield was evident in two recent issues. ANZ Group issued a Tier 2 15-year non-callable 10-year (15nc10) bond in August this year at a credit margin of 168 basis points (bps) and a Tier 2 20-year bullet at 180 bps. The spread-to-swap compensation of just 12 bps for the latter tranche appears insufficient for the additional 10 years in tenor extension (refer Chart 1).

Chart 1: Chasing yield is a common mistake: How the recent ANZ Tier 2 bond issue stacks up

Source: Yarra Capital Management

Likewise, Electricite De France (EDF) in August issued a 10-year Kangaroo bond at 160 bps and a 20-year tranche at 220 bps. Once again, the 60 bps credit spread compensation for the 20-year investment, albeit better compensation than offered by ANZ, still looks insufficient for the tenor extension.

Reality check

Short memories are at play. Investors only need to think back to 2022 to remember what higher interest rates can do to higher-duration securities, especially those issued at tight spreads for the tenor. Following a post-issue bond rally, the ANZ and EDF bonds are currently in-the-money, but if a similar increase in interest rates and credit spreads to that of 2022 occurs in coming years, there would be a significant income loss for holders of both the 20-year ANZ and 20-year EDF bonds.

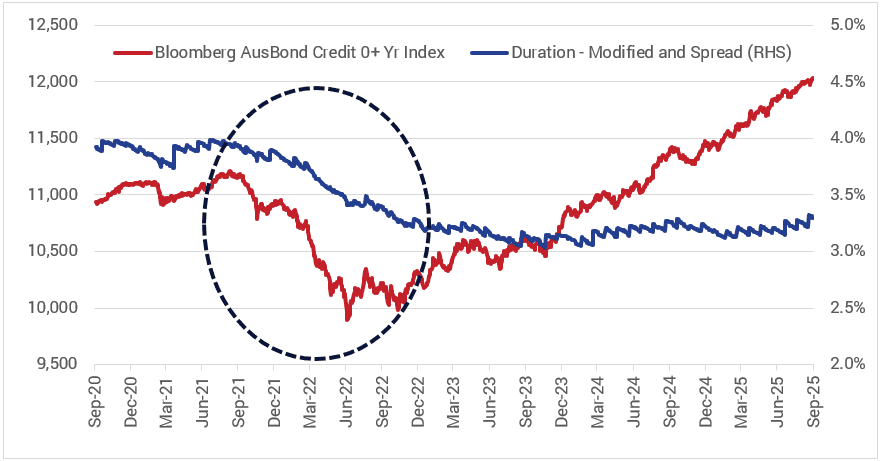

The AusBond Credit Index fell approximately 11 per cent from peak to trough over the course of 2022 with an average credit rating of A+ and interest/spread duration of approximately 3.5 years (refer Chart 2). If interest rates rose by a similar magnitude today, the valuation decline of the ANZ (A-) and EDF (BBB+) 20-year bonds could be three to four times that experienced by the AusBond Credit Index due to their much longer duration and slightly weaker credit quality.

Chart 2: Impact of rate hikes: how the Bloomberg AusBond Credit Index performed in 2022

Source: Yarra Capital Management

In addition to the pricing technicals, it appears that weaker credit fundamentals are also being overlooked. For example, EDF has the added complication that it is owned by a highly indebted French Government, and a history of being partially privatised. If privatised, its standalone credit rating would fall significantly, with bondholders left unprotected due to the absence of a relatively standard change-of-control clause requiring the bonds to be redeemed at par.

Prior to this year’s cuts in official rates, it was not necessary to take the same level of duration risk as today to generate a 6 per cent (or more) yield from 5- to 10-year investment-grade bond investments. But the environment has changed, and some people appear to be jumping at 20-year paper without considering risk-adjusted returns.

Importantly, investors don’t have to cherry-pick direct bonds to receive a running yield of around 6 per cent. In this current environment, a well-managed and highly diversified credit fund can achieve the magical 6 per cent figure and generally a total return above that, with minimal interest rate duration and more appropriate spread duration. Such a fund can also achieve that outcome while maintaining a strong focus on risk management.

Such a portfolio typically holds more than 100 securities drawn from a wide opportunity set, including corporate bonds, structured credit, some private credit and syndicated loans. Moreover, the portfolios run spread duration risk of three to four years, much lower than that of standalone 20-year bonds, retains investment-grade credit quality and is liquid.

In other words, investors with a portfolio of this nature may be exposed to less underlying risk than direct investors with a concentrated parcel of corporate bond holdings. And they may not sacrifice anything in return by choosing an actively managed fund over direct investment in longer-dated bonds.

Phil Strano is head of Australian credit research at Yarra Capital Management

-

AI – auto crop image demo

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere. Ut hendrerit semper vel class aptent taciti sociosqu. Ad litora torquent per conubia nostra inceptos himenaeos.

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere. Ut hendrerit semper vel class aptent taciti sociosqu. Ad litora torquent per conubia nostra inceptos himenaeos.

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere. Ut hendrerit semper vel class aptent taciti sociosqu. Ad litora torquent per conubia nostra inceptos himenaeos.

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere. Ut hendrerit semper vel class aptent taciti sociosqu. Ad litora torquent per conubia nostra inceptos himenaeos.

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere. Ut hendrerit semper vel class aptent taciti sociosqu. Ad litora torquent per conubia nostra inceptos himenaeos.

-

Daily Market Update: 14 November 2025

Jobs number sends local sharemarket lower

The local sharemarket gave up ground on Thursday after an unexpectedly strong jobs report eroded hopes of another interest rate cut by the Reserve Bank of Australia. The unemployment rate fell more than expected to 4.3 per cent in October, from 4.5 per cent. The employment number also surprised, as Australia added 42,200 jobs.

In response, the S&P/ASX 200 Index (ASX: XJO) tumbled 46.1 points, or 0.5 per cent, to 8,753.4, a 10-week low, while the broader All Ordinaries Index (ASX: XAO) slid 44.9 points, also 0.5 per cent, to 9,034.5.

Commonwealth Bank of Australia Limited (ASX: CBA) rebounded from its recent losses, rising $1.81, or 1.1 per cent, to $160.19; while ANZ Group Holdings Limited (ASX: ANZ) receded $1.91, or 4.9 per cent, to $36.94; National Australia Bank Limited (ASX: NAB) retreated 47 cents, or 1.1 per cent, to $42.20; and Westpac Banking Corporation (ASX: WBC) softened 42 cents, or 1 per cent, to $39.44. Biotech heavyweight CSL Limited (ASX: CSL) firmed $2.87, or 1.6 per cent, to $181.93.

Drone technology stock DroneShield Limited (ASX: DRO) cratered $1.03, or 31.4 per cent, to $2.25, after the market learned that almost $70 million worth of the company’s shares had been sold by the company’s chief executive, chairman and a third director. DroneShield shares have tripled over the past year.

Family-tracking app Life360 Inc. (NASDAQ: LIFE) has also had a torrid week, after a third-quarter update spooked the market. Life360 has lost 17 per cent since it reported, but is still up 77 per cent this year. Elsewhere among the interest rate-sensitive technology cohort, small-business accounting software company Xero Limited (ASX: XRO) slipped $12.64, or 9 per cent, to $127.36 after its operating expenses ratio came in above expectations; data centre operator NextDC Limited (ASX: NXT) gave up 61 cents, or 4 per cent, to $14.53; and logistics software company WiseTech Global Limited (ASX: WTC) surrendered $1.48, or 2.1 per cent, to $68.01.

Lithium leads ASX resources higher

Among the major miners, BHP Group Limited (ASX: BHP) put on 27 cents, or 0.6 per cent, to $43.33; Rio Tinto Limited (ASX: RIO) gained $1.18, or 0.9 per cent, to $133.65; and Fortescue Metals Group Limited (ASX: FMG)advanced 48 cents, or 2.4 per cent, to $20.44.

Lithium was the story of the day, as the price of spodumene (the hard-rock lithium ore that yields most of Australia’s production) pushed back through US$1,000 a tonne, from lows of US$600 a tonne earlier in the year. The spodumene price had plunged from US$8,000 a tonne in late 2022, so this feels like a long-awaited rebound. IGO Limited (ASX: IGO), which mines nickel and lithium, surged 89 cents, or 15.3 per cent, to $6.72; Pilbara Minerals Limited (ASX: PLS) jumped 35 cents, or 10.2 per cent, to $3.78; and Liontown Resources Limited (ASX: LTR) lifted 13.5 cents, or 10.3 per cent, to $1.45; while Delta Lithium Limited (ASX: DLI) advanced 2.5 cents, or 13.9 per cent, to 20.5 cents after sweetening its maiden mineral resource lithium estimate at Mt Ida in Western Australia with one of the world’s highest-grade known resources of rubidium (the deposit also contains gold). Mineral Resources Limited (ASX: MIN), which produces iron ore and lithium, slipped 17 cents, or 0.3 per cent, to $51.06, giving back some of its gains earlier in the week.

In gold, Regis Resources Limited (ASX: RRL) gained 35 cents, or 5.1 per cent, to $7.23; Newmont Corporation (NYSE: NEM) was up $5.27, or 3.8 per cent, to $143.00; Evolution Mining Limited (ASX: EVN) strengthened 35 cents, or 3 per cent, to $11.85; Capricorn Metals Limited (ASX: CMM) firmed 39 cents, or 2.8 per cent, to $14.59; Northern Star Resources Limited (ASX: NST) advanced 67 cents, or 2.5 per cent, to $27.02; Genesis Minerals Limited (ASX: GMD) put on 15 cents, or 2.4 per cent, to $6.34; and Ramelius Resources Limited (ASX: RMS)appreciated 8 cents, or 2.3 per cent, to $3.64.

Tech turns tail, takes US markets down

In the US, a tech sell-off meant that the blue-chip Dow Jones Industrial Average (DJI: DJI) could not hold its ground after notching its first-ever close above 48,000 points on Wednesday. The 30-stock Dow Jones plummeted 797.6 points, or 1.7 per cent, to 47,457.22, while the broader S&P 500 Index (NYSE: SPX) gave up 113.43 points, also 1.7 per cent, to 6,737.49, and the tech-heavy Nasdaq Composite Index (NASDAQ: IXIC) bore the brunt, leaking 536.1 points, or 2.3 per cent, to 22,870.36.

The Nasdaq was weighed down by significant falls in heavyweights Nvidia Corporation (NASDAQ: NVDA) (down 6.9 per cent), Broadcom Inc. (NASDAQ: AVGO) (down 4.3 per cent) and Alphabet Inc. (NASDAQ: GOOGL)(down 2.8 per cent). Tech stocks are sensitive to interest rates, and markets have recalibrated their expectations for a December rate cut. Whereas traders as recently as a few days ago were pricing in at least a two-to-one probability of a 0.25-percentage-point cut, that has now flipped to a coin toss, according to futures markets.

Australian Indices Daily % Weekly % 1 Month % 3 Month % 1 Year % ASX 200 -0.5 -0.7 -1.2 0.5 9.8 Financials -1.1 -3.3 -0.5 4.3 11.5 Resources 0.4 3.2 4.4 13.3 27.4 Information Technology -2.7 -5.1 -12.5 -12.6 -3.1 Global Indices Daily % Weekly % 1 Month % 3 Month % 1 Year % US 500 -1.7 0.9 2.6 6.4 15.4 Europe 0.3 2.4 3.3 5.8 28.9 Japan 0.3 -0.8 3.5 6.0 25.1 China top 50 -0.5 0.6 2.8 6.7 39.4 India top 50 -0.3 0.4 2.3 2.9 2.4 Fixed Interest Daily % Weekly % 1 Month % 3 Month % 1 Year % Australian Treasury Bond -0.4 -0.3 -0.6 -0.4 5.9 Australian Corporate Bond -0.1 -0.3 -0.5 -0.2 6.4 US Treasury 0.0 0.5 0.2 1.8 5.5 Cash 0.0 0.1 0.3 0.9 4.1 Commodities & Crypto Daily % Weekly % 1 Month % 3 Month % 1 Year % Gold 1.8 2.7 0.5 23.1 59.1 Silver 5.3 4.7 0.1 33.6 69.5 Crude Oil -4.1 -1.5 -0.7 -3.7 -2.9 Bitcoin -1.6 -1.9 -11.8 -16.3 13.4 -

From criminal law dreams to compliance whisperer

“The traditional law firm model just didn’t work for me as a human,” Catherine Evans says matter-of-factly. “And I could see it didn’t work for clients either.”

Today, as the founder of Kit Legal, Evans leads one of Australia’s most progressive boutique firms specialising in financial services and compliance. Her story is one of quiet rebellion: a lawyer who saw the cracks in the system and decided to build something better.

Evans’ path to entrepreneurship began, somewhat ironically, in disillusionment. “I always thought I’d be a criminal lawyer,” she recalls. But a work experience placement at the Director of Public Prosecutions changed everything. “It was a child rape case. I realised I couldn’t face that darker side of humanity every day. I take my hat off to those who do, but it wasn’t for me.”

Instead, she found herself drawn into corporate law. While still at university, she joined one of Adelaide’s largest firms – now Thomson Geer – in its corporate and commercial team. From there, she went in-house at EDS (later acquired by Hewlett-Packard), supporting the outsourcing of Westpac’s back-office operations. “That’s when I really got interested in financial regulation and the machinery behind banking and finance,” she says.

After a decade of steady progression, Evans became a partner at Cowell Clarke, one of Adelaide’s major firms. It was a professional milestone – and a personal reckoning.

“The turning point came when I had my son,” Evans explains. “I came back from maternity leave, and I was working around the clock. I’d barely see him. Little sympathy was offered from the team, with comments such as ‘you just have to deal with it – see your family on weekends’ often received. And I thought: that’s not the life I want.”

She began questioning the entire economic model underpinning legal practice. “The billable-hour system is broken,” she says. “It rewards inefficiency and excludes the very people who need legal help. Most people put off getting advice until things are really bad – when it’s too late.”

In 2017, she decided to do something radical: she launched Kit Legal with a different set of rules. “No timesheets; no tracking hours; no hierarchy. And no surprises for clients,” she says with a smile. “We went straight to a subscription model. Clients know what they’ll pay each month, and they can call us early – before problems escalate.”

The shift has transformed client relationships. “We talk about fees once, when we start, and never again,” Evans says. “That means we can focus entirely on helping them.”

Kit Legal quickly found its niche in the complex world of financial services law. Evans’ team now focuses exclusively on wealth advisers and wholesale fund managers. The narrower focus allows them to “really know how those industries work,” she says. “It’s not just about knowing the law – it’s about knowing what matters to those businesses.”

At the heart of Kit Legal’s philosophy is a belief that compliance can be a force for good. “I’ve helped clients who’ve received bad advice and lost money,” Evans explains. “But I realised I could have a bigger impact by helping ensure that bad advice doesn’t happen in the first place.”

Evans wants to shift how the industry perceives compliance. “My mission is to make people love compliance – or at least not hate it,” she laughs. “It should feel practical, interactive and common-sense. It’s not about red tape; it’s about good business.”

The firm’s ethos is clear: work only with clients who want to “do the right thing.” Evans says, “We’re not here to help people skirt the law. Our clients want to be seen as trustworthy and professional. That reputation becomes part of their brand.”

If Kit Legal’s model sounds modern, its culture is equally forward-thinking. The firm operates entirely remotely, with senior lawyers based across multiple states. “We meet on Teams every morning and in person a few times a year,” Evans says. “It gives us flexibility and lets us hire great people wherever they are.”

But hiring the right people has been her greatest challenge. “Finding lawyers who think differently is hard,” she admits. “Law is a very traditional industry built on hierarchy and titles – two things we’ve deliberately removed.” At Kit Legal, everyone is simply called “lawyer.” “That caused an uproar at first,” she says, smiling. “People wanted to know their place in the pecking order. But hierarchy doesn’t build collaboration.”

The current team includes three senior lawyers, a head of technology, a marketing and operations lead, and a “chief organiser” who keeps everything – and everyone – running smoothly. The firm’s technology platform underpins its operations and client service. “We don’t want to grow through headcount,” Evans explains. “We want to scale through technology.”

Though based in Adelaide, most of Kit Legal’s clients are in Sydney and Melbourne. “I used to travel constantly,” she says. “Now, we rarely meet clients face-to-face – and it works. Trust can be built digitally.” The firm uses video content and its online platform to create a sense of personal connection. “I want people to feel like they’ve met me, even if they haven’t yet.”

Remote engagement has been central to Kit Legal’s expansion – and COVID-19 helped normalise it. “It validated the model we’d already been using,” Evans says. “We were ahead of the curve.”

The next big growth opportunity lies in anti-money-laundering (AML) compliance. New laws set to take effect in March 2026 will expand the regulated sector from 15,000 to roughly 90,000 entities. “That’s a huge opportunity,” Evans says. “Many accounting firms and financial advisers will need help. We’re perfectly positioned to support them.”

Outside work, Evans lives a world away from the spreadsheets and statutes. She and her husband, a plumber and builder, live on a 17-acre hobby farm in the Adelaide Hills with their two children, Digby (14) and Elspeth (11). “We’ve got animals, gardens, all the chaos that comes with it,” she laughs. “I love yoga, reading – simple things.”

It’s a fitting counterbalance to the intensity of legal innovation. “It keeps me grounded,” she says. “You can’t be too full of yourself when you’re mucking-out a paddock.”

Catherine Evans is part of a growing wave of professionals reimagining the role of lawyers in business — not as reactive advisors, but as proactive partners. Kit Legal’s success suggests the model works: sustainable, scaleable and human.

“What we’re really doing,” she says, “is proving that law doesn’t have to be adversarial or inaccessible. It can be fair, transparent, and genuinely helpful.”

In her quiet, determined way, Evans is showing that the future of law might not look like law at all – and that’s exactly the point.

-

When the game is already half over: The strategic case for secondaries

“Would you prefer to bet on the outcome of a match at the beginning, or halfway through?” Eric Foran poses the question with the calm certainty of someone who already knows the answer. For Foran, partner at Coller Capital, this is the best analogy for understanding secondary private equity. “We are coming into portfolios of private companies typically five to seven years after the investments were made. We can evaluate performance, assess the underlying businesses and price the risk accordingly.”

The past few years have brought a liquidity drought to private markets. Many investors, particularly in traditional private equity funds, have seen exits stall. “Private equity investors simply haven’t received the liquidity they expected,” Foran told The Inside Network’s Alternatives Symposium. “The role of secondaries is to provide that liquidity when it’s needed, and in return, we buy at a discount. That’s the trade.”

The strategy has quietly evolved into a $200 billion market. “Our founder Jeremy Coller had a simple insight 35 years ago: if you commit to something illiquid, at some point you’ll want liquidity. That same insight is what drives this market today.” While the industry has grown tenfold in the last 15 years, the volume of secondary transactions has never exceeded two per cent of the unrealised value of private equity globally. “We’re just getting started,” Foran said. “If turnover increased from 2 per cent to 3 or 4 per cent, the market opportunity is remarkable.”

The appeal is about more than just liquidity. “Secondaries offer compelling risk-adjusted returns,” he says. “You’re buying diversified portfolios, by vintage, geography and manager, at a discount, with no ‘blind pool’ risk. It sits in a very attractive part of the risk-return chart.”

This isn’t theory, and it isn’t new. “We’ve been doing this for 35 years. We have the world’s biggest team dedicated to secondaries. That means we’re all over the world solving liquidity problems,” Foran said. Sometimes, that means buying portfolios of US and European buyout funds from an Asian pension fund looking to raise capital. “In those situations, we tend to get better pricing than if we bought directly from a US institution.”

The market today is split roughly evenly between limited partner (LP)-led and general partner (GP)-led transactions. “In an LP-led deal, the investor has the problem. They want to sell a portfolio, and we provide a single solution.”

GP-led transactions, however, are different. “This is where the manager wants to keep their best company, instead of selling it to another PE firm,” Foran explains. “We help set up a new vehicle, buy that company out of the old fund, and provide the investors with a liquidity option. It’s a way to let managers hold great businesses longer while still returning capital to LPs.”

Crucially, these aren’t top-dollar sales. “This isn’t a price-maximising exercise, it’s a liquidity solution. We’re not coming in at full valuation.” Foran says this gives Coller the chance to build “a portfolio of trophy companies” at attractive prices.

Naturally, not everything on offer is high-quality. “That’s our job, to separate the good from the bad. We might say, ‘we love this, this and this, but not that.’” Coller’s ability to do this effectively is what drives returns. “Our report card is performance.”

Returns are ultimately driven by two things: “The discount you enter at, and the growth of the companies you’re backing. Put those together, and that’s the return for secondary private equity investors.”

As for how investors use the strategy, Foran sees three main profiles. “First, it’s a strategic allocation. It offers diversification, shorter duration and strong internal rates of return (IRRs). Second, it’s an entry point. If you’re starting a private equity portfolio, this is a great way in, particularly with our ‘evergreen’ funds. You get immediate exposure. And third, the tactical allocators, those who see dislocation and jump in. That’s hard to do, but some try.”

Still, for all its maturity, the strategy remains underappreciated. “The awareness of this market is still in its early innings,” Foran says. “What excites me is the opportunity to offer what we’ve done with big endowments and sovereign wealth funds to a broader investor base through evergreen vehicles.” (Evergreen funds are investment vehicles with a perpetual structure, meaning they have no fixed end-date, allowing for continuous capital raising and reinvestment.)

That expansion has already begun. “Three years ago, we had zero dollars in evergreen funds. Today, we have over $3 billion and a team of 75 people focused on that part of the business.” It’s a strategy built on decades of institutional credibility, now being tailored for new markets.

“It’s never been as interesting as it is today,” Foran says. “Liquidity is scarce, but we’ve built a model that thrives in that environment. And the investors who understand that are the ones who stand to benefit most.”

-

Public credit’s quiet revival: Why investors are reassessing the balance

After years in the shadow of its flashier private cousin, public credit is making a quiet but convincing comeback. For Yarra Capital’s fixed income team, the renewed interest isn’t about chasing yield – it’s about rediscovering balance.

“People aren’t suddenly turning bearish on private credit,” says Roy Keenan, portfolio manager at Yarra Capital Management. “They’re just realising they may have been a little too concentrated. Public credit offers liquidity, diversification and right now, pretty compelling returns.”

One of the more powerful drivers of the recent shift has been the Australian Prudential Regulation Authority’s (APRA’s) ongoing clampdown on Additional Tier 1 (AT1) hybrids, which will see roughly $43 billion worth of securities disappear from the market over the next seven years.

“Some investors are happy to roll their hybrids until the end,” Keenan says. “But others are saying, ‘Get me out of here – where else can I go, that keeps me in the credit quality, keeps me mostly in the banks, and in the public markets? That money has to find a home.”

The discussion around ASIC’s stop orders on some private credit products has also prompted advisers to reassess exposures. “It’s not panic,” says Keenan. “But it has made people ask: ‘Am I over-allocated? Am I concentrated in one part of the market?’ That’s a healthy development.”

As those flows migrate, listed investment companies (LICs) and other quasi-public vehicles have stepped in to capture the capital, further blurring the traditional divide between private and public credit. “Once that capital gets raised, managers have to place it – and that’s feeding liquidity into the public market,” he notes.

For Yarra, this has meant a steady, sustainable lift in flows rather than a flood. The firm’s Enhanced Income Fund, for instance, has enjoyed consistent inflows for two years – driven by advisers and private wealth investors seeking liquidity and alternatives to private credit and hybrids, without giving up on yield.

Part of the rethink, Keenan argues, stems from a lack of understanding of what ‘private credit’ really means in the Australian context. “When you go to conferences here, people often equate private credit with property lending. But globally, it’s much broader – corporate lending, warehouse financing, ABS, RMBS, even leveraged buyouts.”

That lack of nuance can create risk. “Not all private credit is equal,” he says. “Investors should be asking, ‘Am I getting paid for the risk I’m taking?’ In some segments, the illiquidity premium has all but disappeared.”

Yarra itself participates selectively in private markets – in warehousing and leveraged buyouts – but avoids direct property lending. “We’re not anti-private credit. We just want to be paid appropriately for the risk and illiquidity,” Keenan says.

Meanwhile, the public credit market in Australia has quietly come of age. Offshore demand for Australian-dollar assets – particularly from Asia – is fuelling issuance and depth.

“I think partially, there is an aspect of ‘de-dollarisation’ happening. There is a lot of Asian interest in the A$, at present, and that’s going into equities, but also into corporate credit,” says Keenan. “Australian corporate credit, relative to the US, looks pretty cheap; the Aussie dollar looks pretty cheap; and we look a pretty safe country from an economic and political viewpoint, too.”

In fact, Keenan says it is the best environment of his career, in terms of deal flow into the public markets.

“We’ve now got real tenor, real volume, real demand. International banks that left ten years ago are back. Australia is now the third-largest credit market in the world, behind the US dollar and the euro. Think about that – it is ahead of the pound and Canadian dollar markets. I’ve waited 25 years for this.”

Recent deals underscore that point. Yarra participated in nine new transactions in a single week – a mix of corporate bonds and subordinated debt. “That’s unheard of. The pipeline’s never been stronger, and we have real choice from a broad array of issuers.”

Keenan points to Electricite de France (EdF), the French multinational electric utility company owned by the government of France, which in August issued a 10-year Kangaroo bond (that is, issued in A$), its first, with a 20-year tranche. “That was a $1 billion issue, but there was $11 billion of demand. As it happens, we didn’t invest in that, but the point is that that’s an example of an issuer that might have gone to the US market in the past, but it could see that Australia’s a big enough market now for it to issue in Australia.

“Partially, that is a result of the dollars flying in from offshore, but also, it’s the asset allocation into credit from local institutional investors, and the wealth market, which has helped as well,” says Keenan.

This surge has both created opportunities – and challenges – for active managers. “Every credit gets a Yarra rating,” he says. “We won’t invest if we can’t research it. The universe is growing so quickly we’re adding coverage constantly, but that’s where active management really shines. The sheer number of issuers just means more work for us – but that’s a good problem to have.”

Even with credit spreads tightening globally, Keenan sees room for value in Australian investment-grade debt. “In the US, you might get 100 basis points for 10-year BBB exposure. Here, you can still get 130 to 150. So you’re being paid more for less risk – and in a stronger currency.”

Yarra’s Enhanced Income Fund currently runs at around BBB+ average credit quality, with forward-looking returns in the 7 per cent–7.5 per cent range – down slightly from the 8 per cent–9 per cent highs of recent years but still robust.

“I’m not promising 9 per cent again,” he says. “But 7 per cent on investment-grade paper, with daily liquidity? That’s a very good outcome.”

Interest rate cuts – with another expected soon – don’t threaten that view. “If you’ve got the right levers in your fund, you can actually benefit from falling rates,” he says. “You pick up capital gains that offset the lower yield.”

So, is the move back into public credit a referendum on private markets? Not quite.

“It’s not fear – it’s pragmatism,” Keenan concludes. “People still like private credit, but they’re realising liquidity has value. They want a mix. They want flexibility.”

That measured tone may be what defines the next phase of Australia’s fixed income evolution. After years of yield-chasing, investors appear ready to rediscover the virtues of balance – and a public credit market finally mature enough to meet them halfway.

-

Mapping the maze: Frameworks, due diligence and the modern alternatives landscape

In a financial ecosystem saturated with jargon, product proliferation and marketing spin, Simon Scott of Genium Investment Partners is on a mission to bring order to chaos. Speaking at The Inside Network’s recent Alternatives Symposium, the senior analyst articulated a cogent, structured approach to research, due diligence and portfolio construction that prioritises clarity over complexity, and substance over spin.

With a quarter-century of experience across Morningstar, Standard & Poor’s, and Macquarie, Scott now leads research at Genium, a firm known for its curated, invitation-only research platform and bespoke client portfolios. Crucially, Genium doesn’t run its own product. “We’re not incentivised to push anything. The list we give to advisers is incredibly tight, and that’s deliberate,” Scott said.

His preferred entry point to alternatives isn’t via asset class labels or marketing narratives, but through risk factors. “What am I trying to seek with an alternative?” Scott asked rhetorically. “I’m trying to modify, diversify or eliminate some sort of risk factor.” From this starting point, he lays out a three-dimensional framework that organises strategies not by asset class but by function: modifier, diversifier, or eliminator of risk.

Modifiers, he explained, might include long-short strategies in equities or direct lending in fixed income, offering the same risk exposures as traditional assets but with reduced intensity. Diversifiers, on the other hand, represent a conscious trade-off, taking on a different risk in exchange for leaving behind another, such as in risk premia strategies. Lastly, eliminators are designed to fully neutralise a risk factor, incorporating volatility strategies, tail hedges or convexity trades.

This “cube” model simplifies portfolio construction for advisers, especially when the end-client is a high-net-worth investor or family office with a limited appetite for complexity. “We don’t need to worry about what label we’re calling the strategy,” Scott said. “Just make it a very clean, simple cube, even if it’s 10 o’clock on a Monday”.

Beyond classification, the structural appropriateness of an investment vehicle looms large in Scott’s due diligence process. He is candid about the misalignments he sees. “The structure’s got to be appropriate for the assets, not for the person marketing the product,” he said. He noted, for instance, that at times local structures are more aligned to the needs of the designer rather than the end investor.

Scott cautioned advisers to look past surface-level comparisons and interrogate what sits underneath. For example, the allure of “mandated liquidity” in certain vehicles may obscure the incompatibility of that structure with underlying illiquid assets. Similarly, vehicles designed for easy multi-jurisdictional sale might not offer the right alignment with the investment’s risk-return profile.

The next layer of scrutiny is managerial capability. Scott sees a convergence between two camps: large, traditional asset managers expanding into alternatives, and niche, specialist investors crossing into institutional-grade operations. “The big players have fantastic pipes, systems, compliance, infrastructure, but they’re new to investing. The boutiques have the investing chops but lack the same governance rigour,” he noted. Successful investment, then, lies in finding the right balance of operational robustness and genuine subject matter expertise.

Due diligence must follow the money, literally. “Look at where the cheque goes. What are the roadblocks? Who are your co-investors?” Scott advised. The diversity of global investors, especially in terms of time horizons and yield expectations, introduces a host of complexities. “Guaranteed, it won’t be the people in this room. It’ll be 25 other markets with totally different definitions of ‘long term’,” he warned.

Scott’s commentary also touches on the emergent complexity in secondaries and liquid alternatives. He voiced scepticism about the pricing inefficiencies in secondary markets. “I get the conceptual idea, but I don’t get why high-quality assets need to be so cheap in a functioning market,” he said. His comments reflect a broader caution about herd behaviour and the eagerness to chase narrative trends without enough grounding in fundamentals.

Liquid alternatives, meanwhile, offer a fascinating paradox. “We’ve got some of the longest-standing liquid alts managers presenting, trading the most liquid assets in the world. Yet all the focus is on everything else,” Scott remarked. He suggested that the industry’s preoccupation with opaque, illiquid strategies might be overlooking the value and transparency offered by liquid alts.

Perhaps most telling is Scott’s granular view on what makes a portfolio truly diversified. “We’ve got 55 direct lending, middle-market managers in that modifying sleeve,” he revealed. But Genium’s approach is not to keep stacking on more of the same. “We’re looking at asset-backed, at aviation, transport, rights and royalties. The goal is diversity away from ‘just more corporate loans’”.

For advisers, the takeaway is that real research is bespoke, discriminating and ultimately designed to be used. Scott’s framework doesn’t just sort investments, it helps advisers construct narratives that resonate with clients, ones based on function, not fashion. In a world where label inflation is rife and complexity often masquerades as sophistication, his message is refreshingly grounded.

In an industry still grappling with how to integrate alternatives in a post-Hayne environment, Scott’s approach sets a high bar. It reminds advisers that sound research begins with asking the right questions, not about performance first, but about purpose.

-

Gold: The quiet repricing of trust

During my university days, I worked part-time at a large foreign exchange shop in Washington, D.C. The city was full of diplomats and staff from the IMF and World Bank, so the counters never sat quiet. Beside me was the precious metals booth, run by a man about 15 years my senior. He had lived through Vietnam, then Nixon taking the US dollar off gold, then the Hunt brothers’ silver saga, then the US dollar’s swings around the Plaza and later the Louvre Accord.

Although G7 central banks worked to keep the reserve currency stable, he still didn’t trust the US dollar. So, he sold gold Krugerrands with conviction and told customers that gold bought you sleep. While I never bought any, his line stayed with me.

Decades later, that sentiment has re-emerged, only now through central banks themselves. Today, two signals frame the present. Recent World Gold Council (WGC) tallies show official sector buying near 1,000 tonnes a year. At the same time, IMF data show a slow drift in reserve composition, with the US dollar’s share edging down from about 70 per cent to the mid-50s. One speaks in tonnes, the other in mix. Together they show how central bank balance sheets change when the world feels less stable than the models implied.

The geographic centre of global reserves has visibly shifted. By IMF measures, more than half of global reserves now sit across Asia, the Middle East and emerging markets. The institutions holding most precautionary assets are also those most exposed to trade invoicing in US dollars and to funding squeezes where trust itself has become a sought-after asset. Not surprisingly, therefore, their priority is resilience.

China is the scale case. Total reserves sit around $US3,500 billion. About seven per cent is in gold, or about $US300 billion. Put that in perspective: China’s gold holdings alone are nearly three times Australia’s total reserves and would rank among the world’s total top 10. That’s scale.

So why build that position? Their motive isn’t carry. It’s portfolio resilience for a more uncertain world. Many emerging-market reserve managers have liabilities and trade flows anchored to the US dollar. Diversifying the asset side limits future currency mismatch and lowers political dependence. Geopolitical signalling and balance-sheet diversification often overlap. Gold helps because it is nobody’s debt to pay. It clears broadly, sits outside sanction channels, and is recognised across legal systems. Those traits travel well when regimes shift.

Better to read the central bank buying as institutional housekeeping, not a momentum trade. When the reserve currency still dominates but feels less permanent, central banks seek optionality. Such an adjustment quietly shows up in composition, not headlines. A few tonnes a month, another small allocation next quarter. It looks unexciting by design, which is exactly the point. The price moves fast. Reserve policy moves slow. The latter is my subject.

That same slow adaptation runs through the system’s plumbing. Payment experiments are advancing in local-currency settlement, forming an alternative to SWIFT, and in central-bank digital currency pilots. The goal is reduced friction, more routing choices and fewer single points of failure when correspondent chains get politicised. This is about keeping trade and finance moving when one corridor shuts, rather than forming a rival bloc.

Reserve portfolios mirror that instinct. More assets that travel across regimes, fewer that rely on one gate. Gold sits outside Basel’s liquidity framework, which classifies Treasuries as high-quality collateral. That exclusion helps explain why its bid is official, not financial.

Correlation riskFrom a risk lens, bullion covers two exposures. First, access risk: sanctions, custody rules or settlement protocols can change overnight. Second, correlation risk: the same shock that hits risk assets can also tighten dollar funding. In that moment, an asset that is not anyone’s debt steadies the balance sheet by stepping out of the correlation chain.

Markets often treat this as a call on price, yet I highly doubt that. The question is more functional. Does the asset store purchasing power through cycles? Does it clear across borders without permission? Does it hold value when politics touches money? Gold is one of the few assets that can answer ‘yes’ to all three.

A brief aside on cryptocurrency. It too captures much of the scepticism around fiat currency, yet its liquidity leans on stable coins, which themselves are largely backed by US Treasury bills. Few central banks hold crypto in reserves. Gold already sits inside the system. That contrast between cryptocurrency and gold is enough.

Step back to the frame. The post-1980s order relied on coordination. G7 central banks would act together when exchange rates overshot. Trade lengthened supply chains on the assumption that policy would stay predictable. Those assumptions now feel weaker. Settlement systems keep testing new workarounds rather than rely on old models. In such an environment, safe assets are defined by what they do, not their passports. Dollar share remains structurally high, but the world is visibly testing alternatives.

None of this projects what tomorrow’s gold price will be. Real rates and growth obviously still matter. The point, however, is narrower. Official portfolios are now being rebuilt for function in this new era of disorder and political uncertainty. WGC tonnes on one side, evolving currency shares on the other. The scale helps anchor that story.

More than half of global reserves are now in Asia and the emerging world. Each step nudges the mix towards assets that travel, clear, and hold value when the script changes. I don’t know where gold is headed tomorrow, but I’m more certain that political disruption will keep rising. The only thing harder to predict than gold today is Trump.

As reserves diversify, auction mechanics inevitably change. A lighter official bid raises the bar for US Treasury issuance and makes ad-hoc US dollar stabilisation harder to organise. The result is a currency that trades more on domestic policy credibility and less on coordinated support; a costly adjustment for any nation accustomed to a G7-coordinated anchor.

I think back to the metals desk in Washington. Then, coordination bought stability. Today, increased diversification buys resilience. If you manage risk for a living, the lesson is simple enough. Design for the day when policy uncertainty moves faster than trust can follow. That’s what the central banks are signalling with their balance sheets. Gold buys you sleep; only now it’s central bankers who are saying this. -

Daily Market Update: 13 November 2025

CommBank drags local market lower

Ongoing weakness in index heavyweight Commonwealth Bank of Australia Limited (ASX: CBA) and tech shares spelled trouble for the Australian market on Wednesday, and that’s how it panned out, with the benchmark S&P/ASX 200 Index (ASX: XJO) losing 19.3 points, or 0.2 per cent, to 8,799.5, and the broader All Ordinaries Index (ASX: XAO) easing 19 points, also 0.2 per cent, to 9,079.4.

CBA (ASX: CBA) shed a further $5.02, or 3.1 per cent, to $158.38, taking its loss since Tuesday’s quarterly update past 9 per cent, and pushing its share price below $160 for the first time since April. Among its big bank peers, Westpac Banking Corporation (ASX: WBC) lost 19 cents, or 0.5 per cent, to $39.86; and National Australia Bank Limited (ASX: NAB) softened three cents, to $42.67; but Australia and New Zealand Banking Group Limited (ASX: ANZ) climbed 69 cents, or 1.8 per cent, to $38.85.

Also at the heavyweight end of the index, biotech giant CSL Limited (ASX: CSL) appreciated 94 cents, or 0.5 per cent, to $179.06. Among the big miners, BHP Group Limited (ASX: BHP) lifted 27 cents, or 0.6 per cent, to $43.06; Rio Tinto Limited (ASX: RIO) gained $2.91, or 2.2 per cent, to $132.47, as its massive Simandou iron ore project in Guinea got under way; and Fortescue Ltd (ASX: FMG) put on 6 cents, or 0.3 per cent, to $19.96.

Australia’s S&P/ASX All Technology Index (ASX: XTX) dropped 3.3 per cent, led by family tracking app Life360 Inc. (ASX: 360), which sank $5.99, or 13.1 per cent, on weaker-than-expected customer growth. Small business software company Xero Limited (ASX: XRO) gave up $3.19, or 2.2 per cent, to $140.00; interconnection services company Megaport Limited (ASX: MP1) fell 25 cents, or 1.6 per cent, to $15.05; and data centre operator NEXTDC Limited (ASX: NXT) eased 38 cents, or 2.4 per cent, to $15.14.

Resources strength can’t hold market up

In mining, iron ore and lithium producer Mineral Resources Limited (ASX: MIN) surged a further $4.31, or 9.2 per cent, to $51.23, as the market digested yesterday’s announcement of the $1.2 billion sale of a 30 per cent stake in the miner’s lithium operations to South Korea’s POSCO Holdings Inc. (KRX: 005490). Mineral Resources Limited (ASX: MIN) is up 15.3 per cent since the deal was announced. IGO Limited (ASX: IGO), which produces nickel as well as lithium, advanced 20 cents, or 3.6 per cent, to $5.83, while lithium miner Liontown Resources Limited (ASX: LTR) leapt 7.5 cents, or 6 per cent, to $1.315. Rare earths producer Lynas Rare Earths Limited (ASX: LYC)retreated 39 cents, or 2.7 per cent, to $13.83.

In gold, Northern Star Resources Limited (ASX: NST) moved 36 cents, or 1.4 per cent, higher to $26.35; Evolution Mining Limited (ASX: EVN) gained 23 cents, or 2 per cent, to $11.50; Newmont Corporation (NYSE: NEM) was up $1.21, or 0.9 per cent, to $137.73; and Regis Resources Limited (ASX: RRL) gained 16 cents, or 2.4 per cent, to $6.88.

Energy stocks gained as oil prices rose on the back of US sanctions on Russian oil producers, with Woodside Energy Group Ltd (ASX: WDS) rising 37 cents, or 1.4 per cent, to $26.92; Santos Limited (ASX: STO) adding 11 cents, or 1.7 per cent, to $6.69; and Brazilian-based producer Karoon Energy Ltd (ASX: KAR) surging 7 cents, or 4.4 per cent, to $1.65.

Dow Jones clears 48,000

In the US, the blue-chip Dow Jones Industrial Average (INDEXDJX: DJI) notched its first-ever close above 48,000 points on Wednesday, as Wall Street looked ahead to a potential end to the record-breaking US government shutdown. The 30-stock Dow Jones Industrial Average (INDEXDJX: DJI) closed up 326.86 points, or 0.7 per cent, at 48,254.82, while the broader S&P 500 Index (INDEXSP: SPX) eked out a 4.31-point gain, to 6,850.92, and the tech-heavy Nasdaq Composite Index (INDEXNASDAQ: IXIC) retreated 61.84 points, or 0.3 per cent, to 23,406.46.

European stocks were mostly higher, with the STOXX Europe 600 Index (STOXX: SXXP) advancing 0.7 per cent.

Australian Indices Daily % Weekly % 1 Month % 3 Month % 1 Year % ASX 200 -0.2 0.2 -1.6 0.3 10.7 Financials -1.0 -2.2 -0.9 2.4 14.0 Resources 1.3 3.9 3.2 12.8 24.6 Information Technology -2.0 -4.0 -11.6 -10.3 1.2 Global Indices Daily % Weekly % 1 Month % 3 Month % 1 Year % US 500 0.1 0.4 4.8 6.4 15.2 Europe 1.2 2.2 3.5 5.5 29.1 Japan 0.8 1.6 3.5 5.0 25.1 China top 50 1.1 2.6 1.0 8.6 35.9 India top 50 1.4 0.2 2.1 3.0 2.5 Fixed Interest Daily % Weekly % 1 Month % 3 Month % 1 Year % Australian Treasury Bond 0.2 -0.3 0.1 0.1 6.1 Australian Corporate Bond 0.1 -0.2 0.1 0.2 6.7 US Treasury 0.2 0.0 0.6 1.8 5.3 Cash 0.0 0.1 0.3 0.9 4.2 Commodities & Crypto Daily % Weekly % 1 Month % 3 Month % 1 Year % Gold -0.6 3.5 4.0 23.1 57.5 Silver 0.3 7.2 1.2 35.7 64.4 Crude Oil 1.7 2.5 4.6 -0.4 1.7 Bitcoin -2.7 -2.1 -15.3 -14.9 8.9